MARKET EXTRA

What July’s steep drop in Treasury yields is saying about path forward for the U.S.

‘People are more confident that the worst is in the past’ on inflation, strategist says

Follow MarketWatch in Apple News

U.S. government debt finished the final trading day of July with its longest monthly string of rallies in three years, helped by easing concerns about supply and the widely anticipated start of the Federal Reserve’s rate-cutting cycle in a few months.

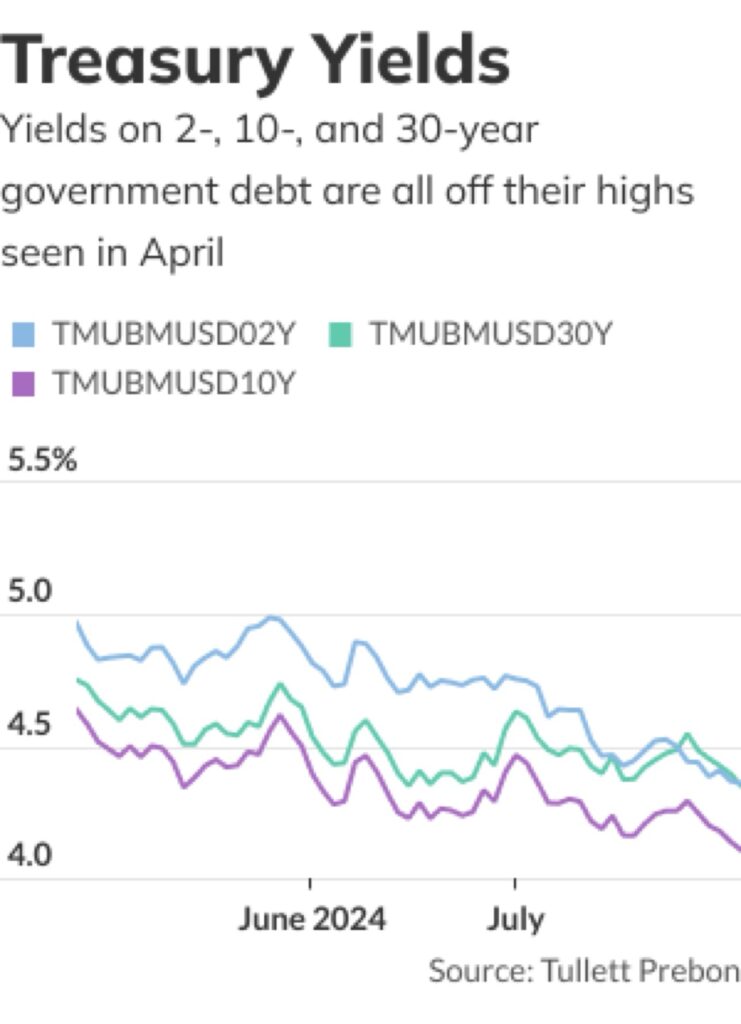

On Wednesday, Treasurys scored a third straight monthly gain, the longest since a four-month streak that ended in July 2021. The current rally has sent 2- BX:TMUBMUSD02Y and 10-year yields BX:TMUBMUSD10Y down by more than a half percentage point from the year-to-date highs seen in late April. Meanwhile, the rate on the longest-dated maturity, the 30-year bond, BX:TMUBMUSD30Y has fallen 44.9 basis points over the same time.

Analysts said the rally is a reflection of growing optimism that the U.S. has moved past its worst bout of inflation in more than 40 years, adding to the appeal of government debt.

Easing inflation concerns are also reflected in falling yields on 5- and 10-year Treasury inflation-protected securities. As of Wednesday, they were each below 2% and at their lowest levels since early April and late March, according to Tradeweb data. The 5-year TIPS rate has remained consistently below 2% since July 10. Meanwhile, the 30-year TIPS rate was 2.149% as of 3 p.m. Eastern time, its lowest level in about two weeks.

“It all comes down to that second month of good CPI” for June, said macro strategist Will Compernolle at FHN Financial in New York, referring to the June consumer-price index released on July 11. “People are more confident that the worst is in the past. And the value on U.S. government debt is better when inflation is low because it means more Fed easing. People are regaining the confidence they had at the start of the year.”

Interestingly, the bond market’s moves are altering the shape of the Treasury yield curve in a way that’s more commonly associated with negative economic developments.

Yields on shorter-term debt have fallen at a faster pace than those on longer-term ones, resulting in a shrinking spread between the two and a steepening of the curve. Such a steepening, following a prolonged period of inversion, is often read as an indication of the bond market’s growing conviction that a recession is nearing and will require multiple rate cuts by the Federal Reserve.

What remains to be seen for the remainder of the year is if the Fed will be able to navigate a soft landing and avert a recession, or whether economic growth and inflation will go in opposite directions. Fed-funds futures traders are mostly expecting a total of three quarter-percentage-point rate cuts by year-end.

Bond-market traders are also watching for developments leading up to the Nov. 5 presidential election. They began the month concerned about how the U.S. presidential election would be the biggest risk in the second half of the year, given the possibility that neither major party would embrace fiscal restraint. There’s since been a rethink of this notion after a pair of announcements by the Treasury Department this week helped ease the market’s worry about supply.

On Monday, the department sharply lowered its third-quarter borrowing estimate to $740 billion, down by more than $100 billion from its estimate three months ago. And on Wednesday, it said it does not anticipate the need to increase nominal coupon or floating rate note auction sizes “for at least the next several quarters.”

“The fiscal trajectory is concerning in the next few years and people kept expecting coupon auction sizes to increase,” Compernolle said via phone on Wednesday. “What we learned this morning is that those increases are further in the future and people investing in long-term debt can breathe a sigh of relief.’’

The bond market’s main focus through year-end will be on “the Fed and politics,’’ he said. Traders will be responding more strongly to developments in the Nov. 5 election as that date draws near, while waiting to see if the Fed can come through on traders’ expectations for three quarter-point rate cuts.

On Watch by MarketWatch

How the news of the day affects the economy and your wallet. A new podcast from MarketWatch.

Recent Comments